Financial Advisory

- Cooperation with Private Equity Funds

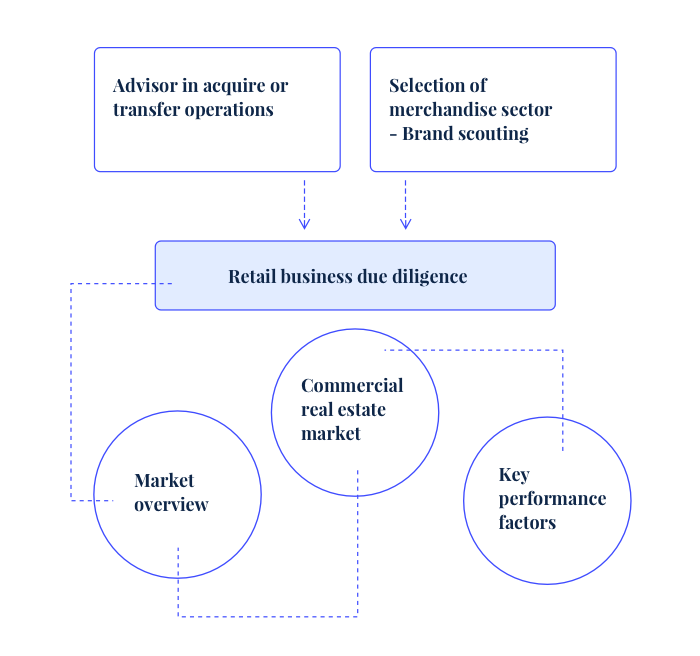

- Retail business due diligence

- Merger & Acquisition

Private Equity Funds

At the end of the Nineties, private equity funds started to operate in the non-food sector. We were there, to offer investors an insider view of the company and the target market in the acquisition process. From then, Reno Your Retail Partners has been consulted by buyers and sellers in numerous transactions and, at a preliminary stage, in due diligence processes: alongside the top-down approach adopted by the investor and by multinational general consultants, we offer our specialist approach to retail with a bottom-up logic, starting from the analysis of the average sales receipt, from stock at the point of sale, its profitability, distribution and locations.

Retail business due diligence

Retail business due diligence studies the company from the inside, from the bottom, and allows us to supply complementary and objective information, for a more detailed comparison analysis, together with an evaluation of the current and future potential of the retail chain. The objective of a rapid company expansion again focuses on the location aspect. Only a precise knowledge of the current and potential future availability of locations consistent with the concept can guarantee the sustainability of the project the investor is considering.

Internalisation processes

The internalisation processes are not limited only to agreements of a commercial nature but may also lead to strategic choices that have a high impact on the corporate structure. The partner/master franchisee can assume different roles and relevance on the basis both of the country complexity and the matrix (distribution, production, property or financial) of the same partner.